IRS Raises Exemption Limits as Potential TCJA Expiration Looms

The federal estate tax exemption has been increased for 2025, offering higher limits for taxpayers. While this adjustment is in line with inflation expectations, it carries more weight given that 2025 might be the last year of the current rules under the Tax Cuts and Jobs Act (TCJA).

If the TCJA sunsets at the end of 2025 without new legislation, estate tax exemption amounts could drop to pre-2018 levels in 2026. Until then, the newly increased exemption provides a tax-saving opportunity for many estates, potentially shielding more assets from federal taxation.

2025 Estate Tax Exemption Update

The federal estate tax only applies to estates that exceed a certain threshold. In 2025, that limit has been raised:

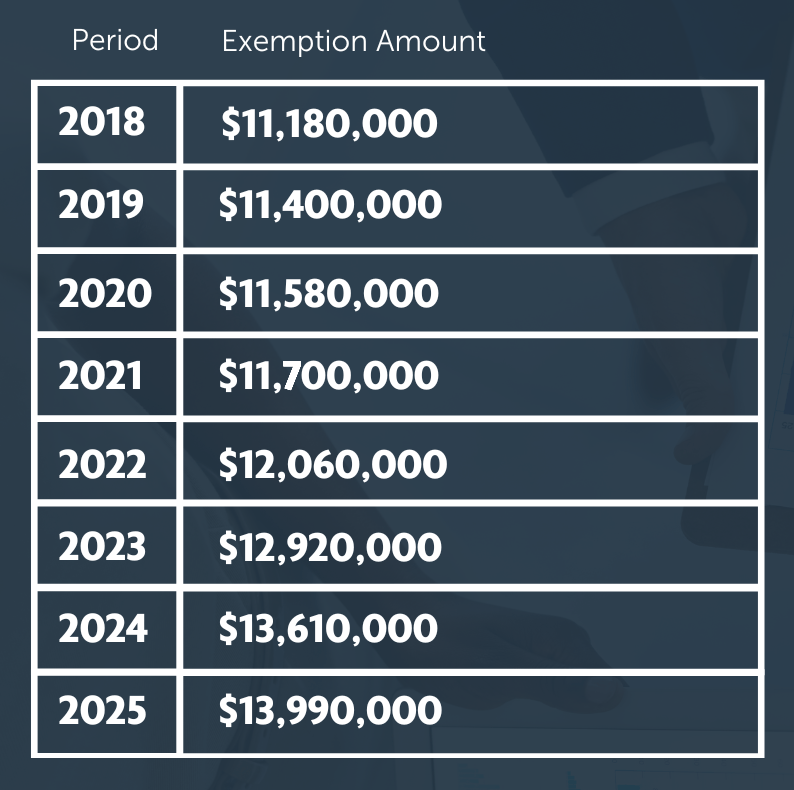

- For individuals, the exemption rises to $13.99 million, up from $13.6 million in 2024.

- For married couples, the exemption increases to $27.98 million, compared to $27.22 million in the prior year.

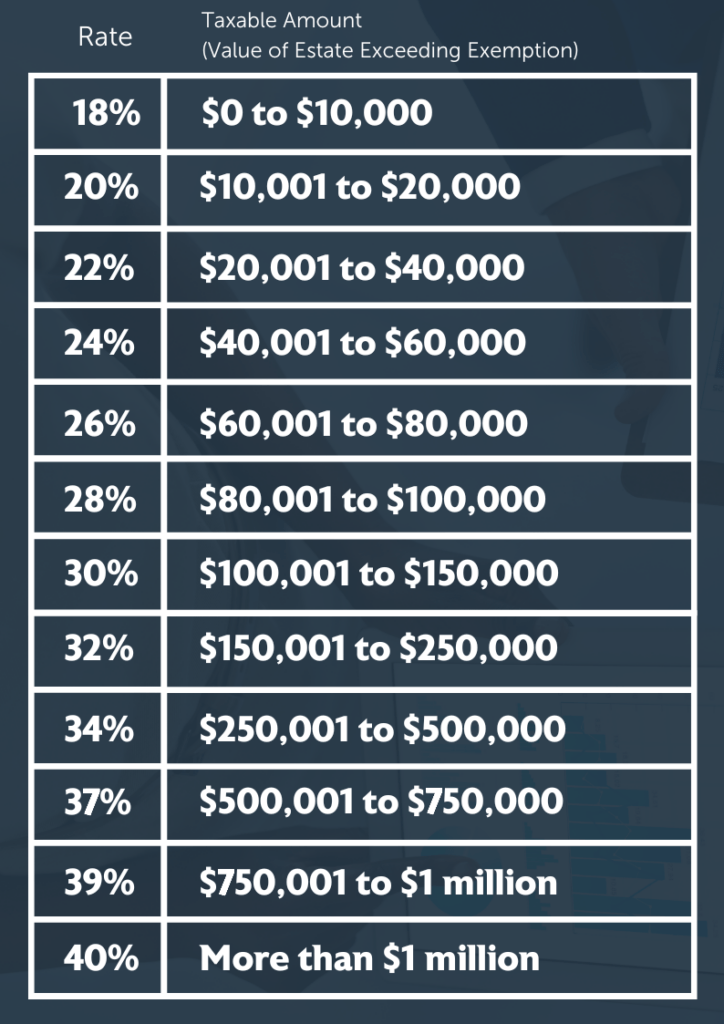

Federal Estate Tax Rates for 2025

Although relatively few estates exceed the exemption, those that do may face a steep tax bill. The federal estate tax rate applies progressively, reaching a maximum of 40% for estates that surpass $1 million beyond the exemption limit.

Here’s a breakdown of how rates apply to the taxable portion of an estate:

Potential Changes After 2025

Without Congressional intervention, the higher exemption amounts under the TCJA are set to expire at the close of 2025. Beginning in 2026, the federal estate tax exemption would return to a base amount of $5 million, adjusted for inflation. However, these amounts will continue to be indexed annually to account for inflationary changes.

Any tax-free gifts made under the current lifetime gift and estate tax exemption will generally remain protected from increased tax liability after the TCJA provisions end.

Historical Federal Estate Tax Exemptions (2018-2025)

Here’s a quick look at the changes in exemption amounts over the past few years:

State-Level Estate and Inheritance Taxes

In addition to federal estate taxes, some states impose their own estate taxes, often with lower exemptions. For instance, Massachusetts has a state-level exemption of just $2 million, and this threshold isn’t adjusted for inflation.

Several states also levy an inheritance tax, which taxes the recipients of an estate based on the amount they receive. For example, Nebraska’s inheritance tax applies to adult children on inheritances over $100,000, while Kentucky offers a mere $1,000 exemption to nieces and nephews.